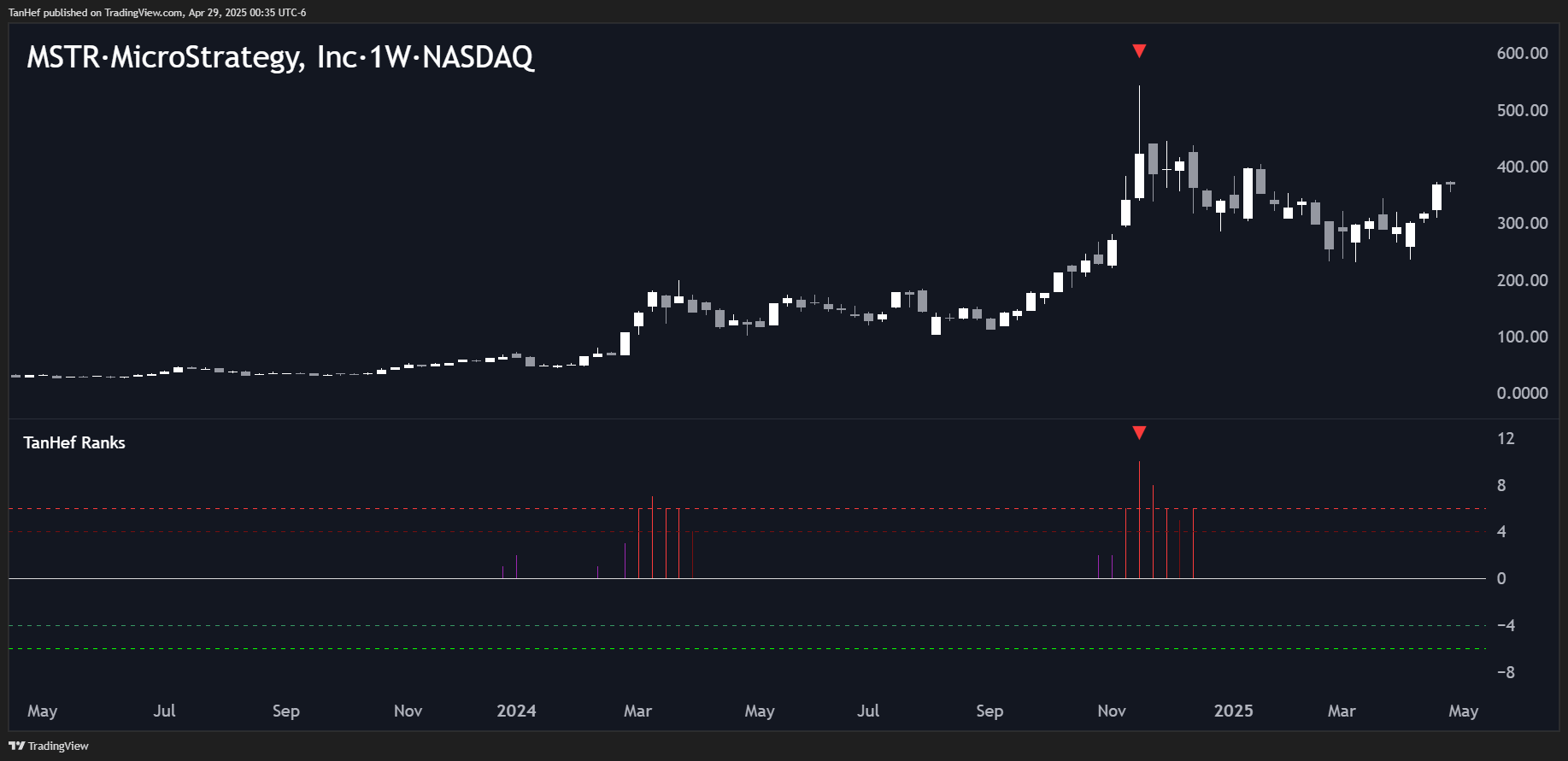

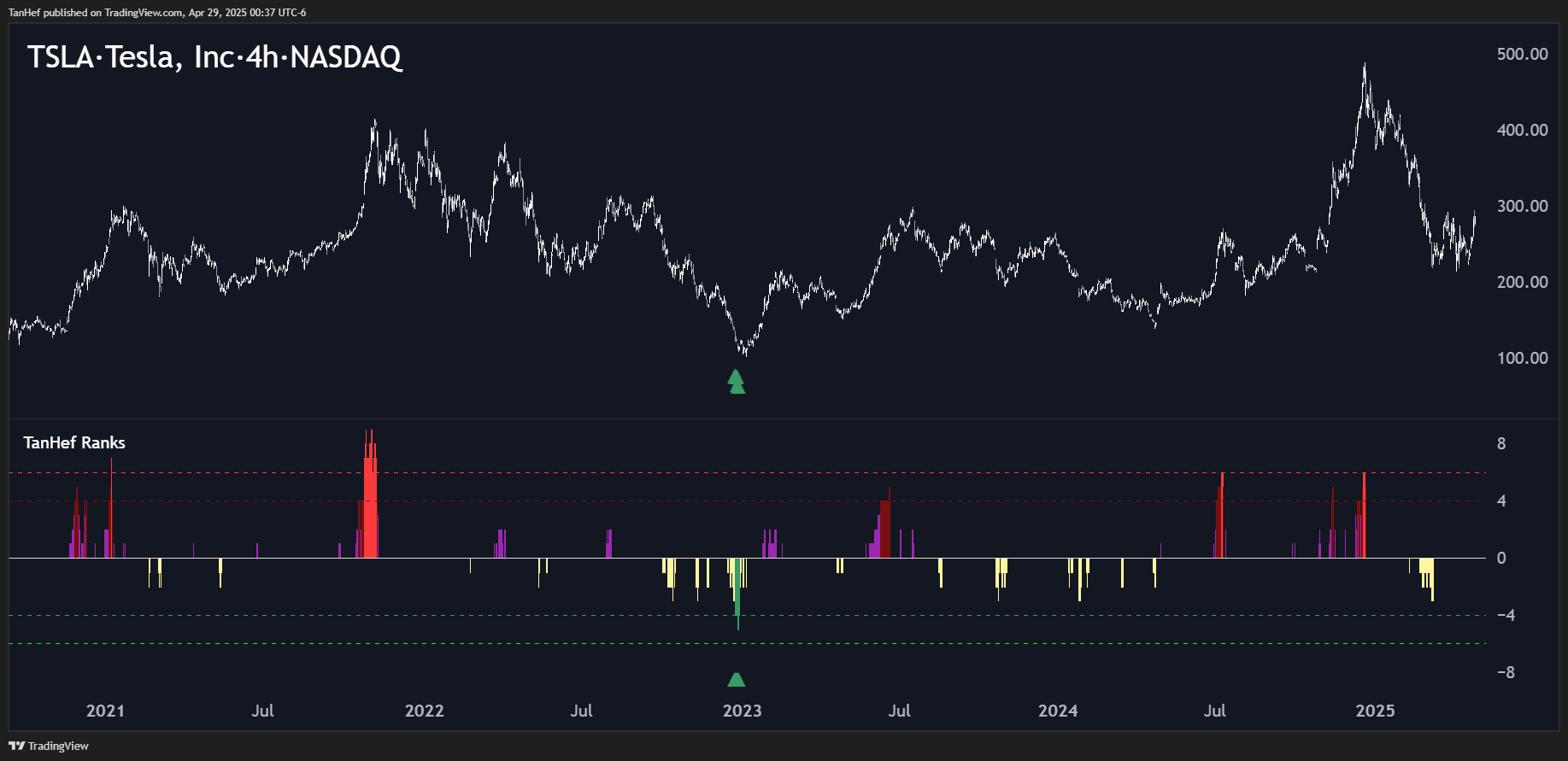

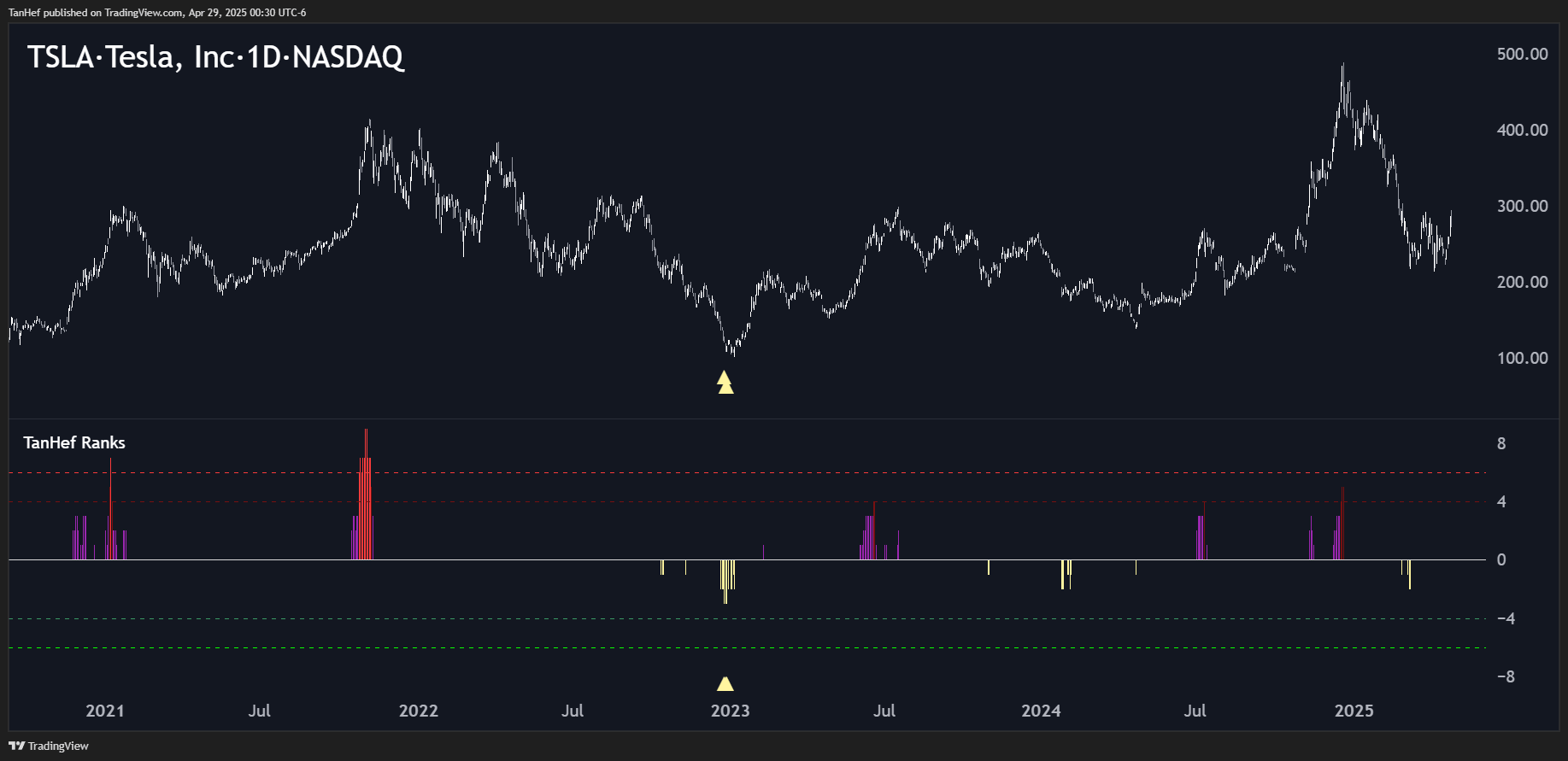

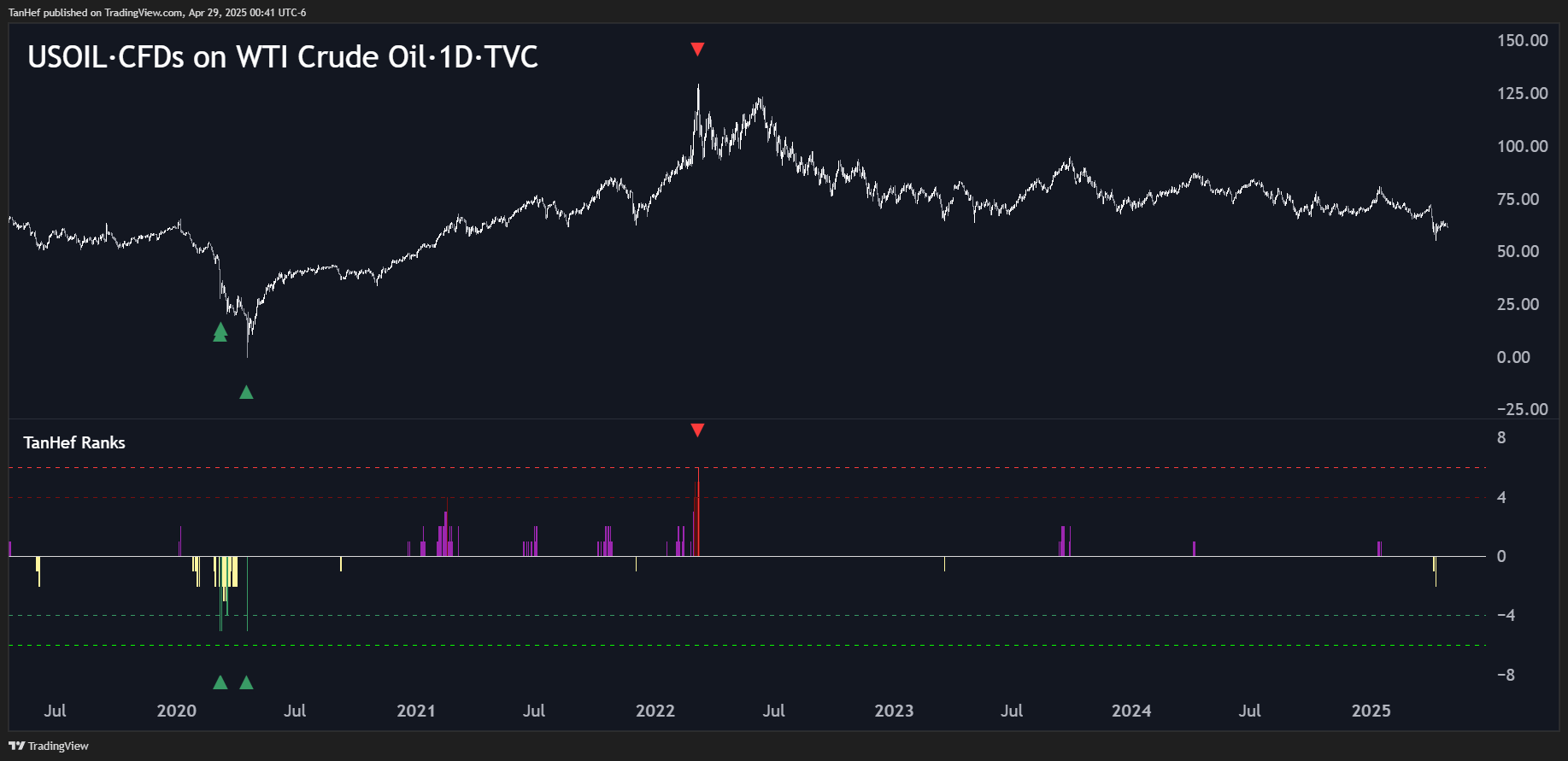

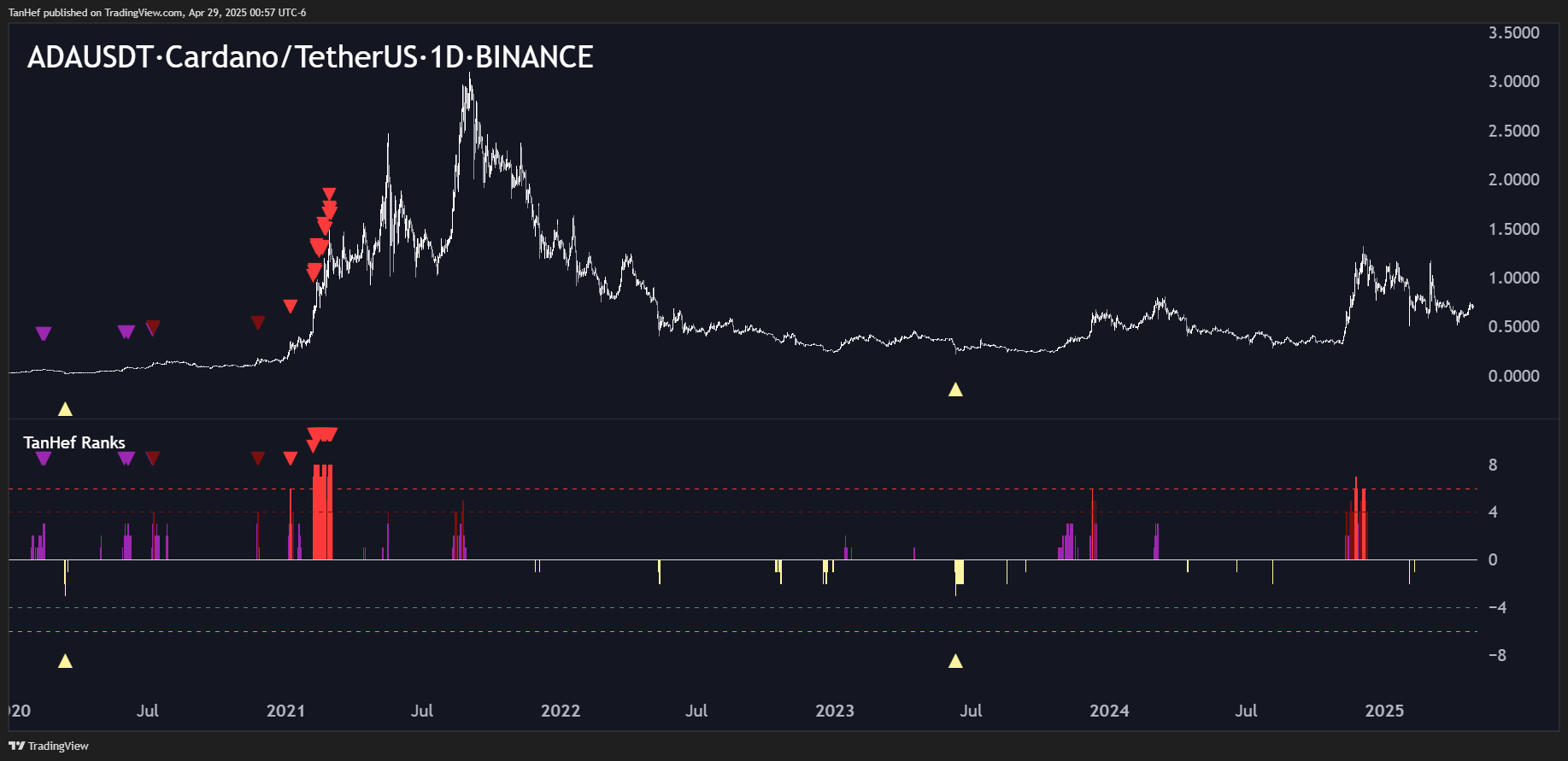

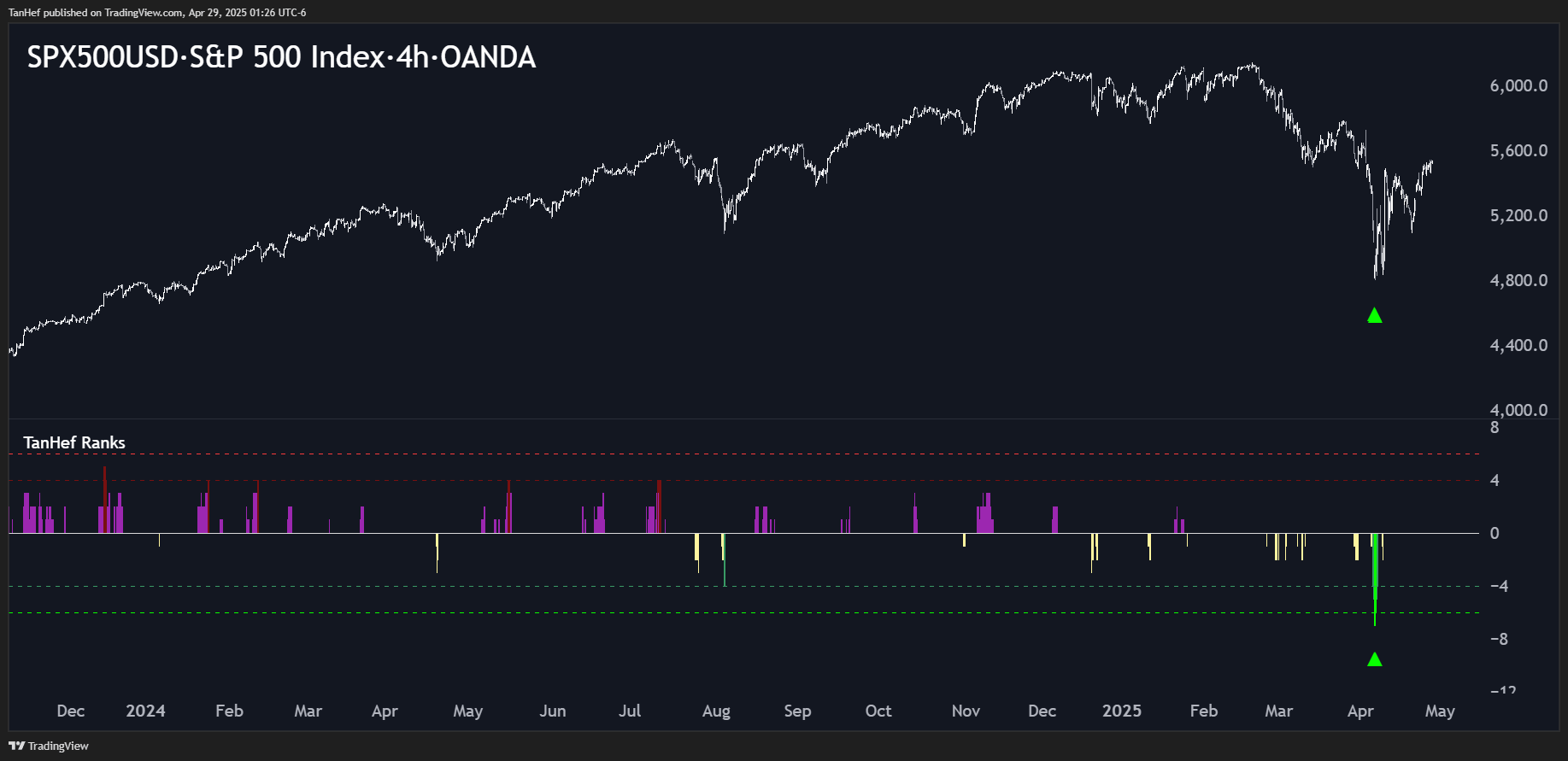

TanHef Ranks — Find Tops & Bottoms

Easy-to-read signals with time-saving alerts. No Repainting! ⓘ

Tutorial

TanHef Ranks helps you stay patient, avoid bad trades, and make decisions when it counts — get alerts instead of staring at charts.

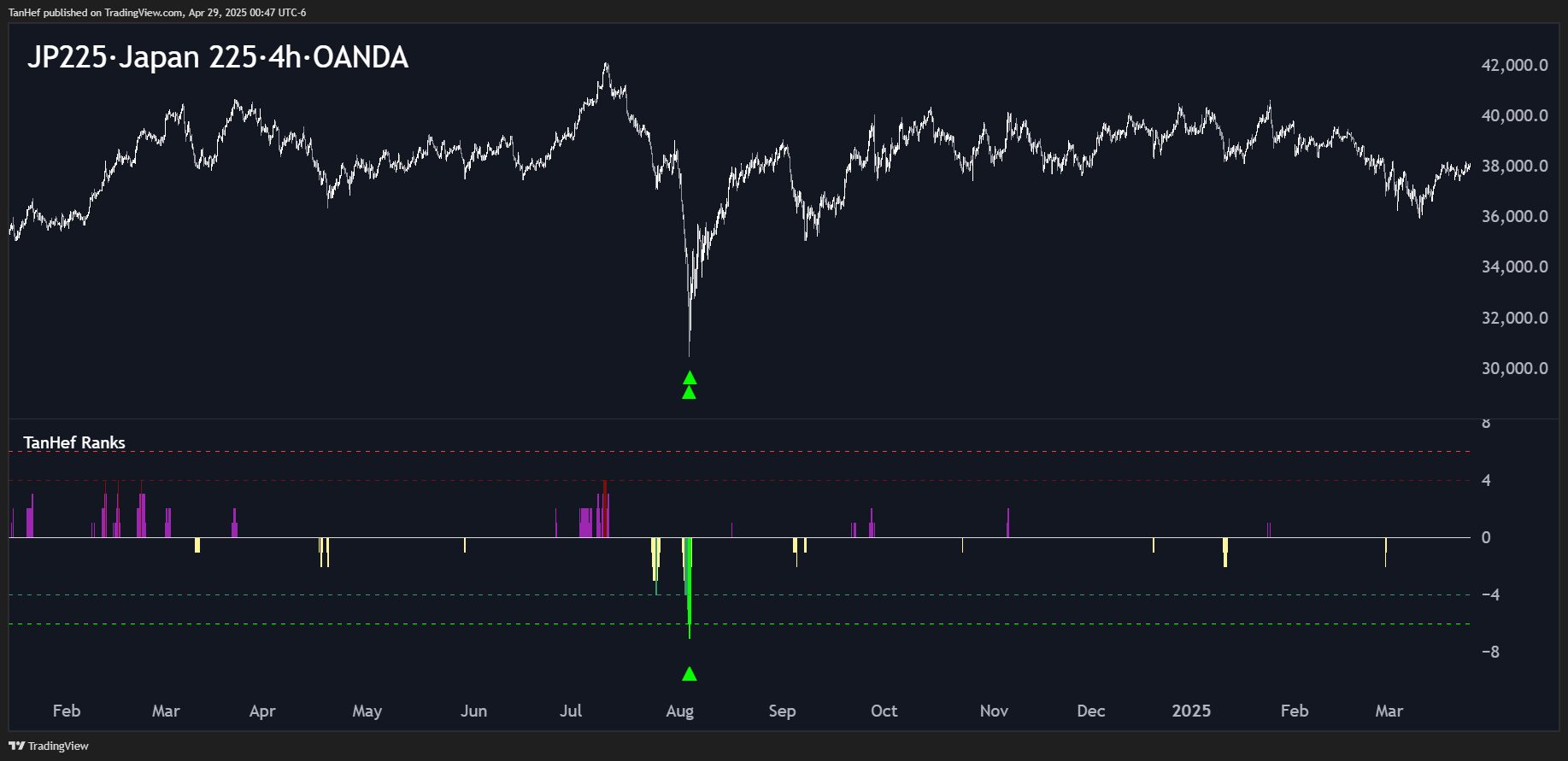

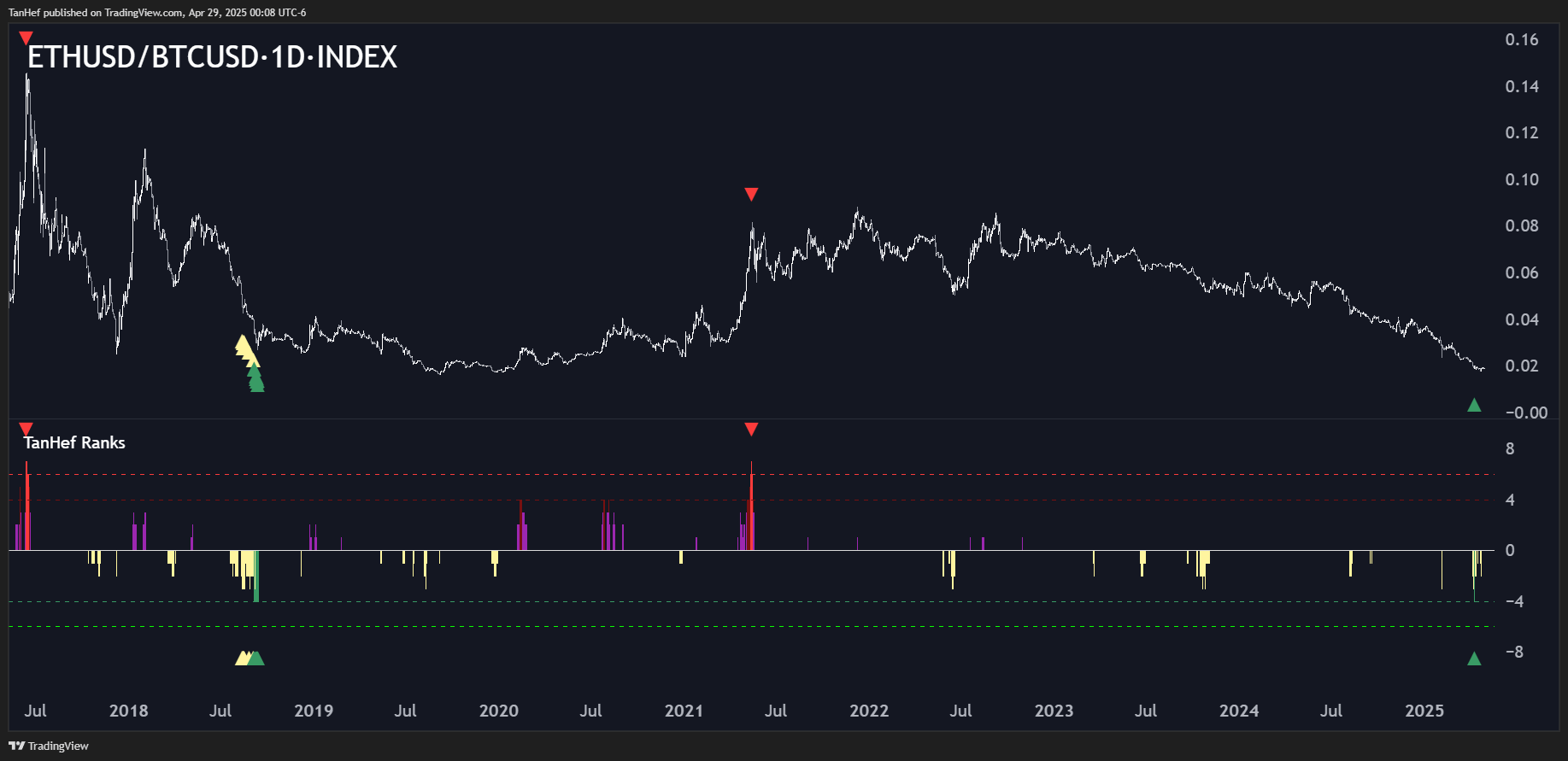

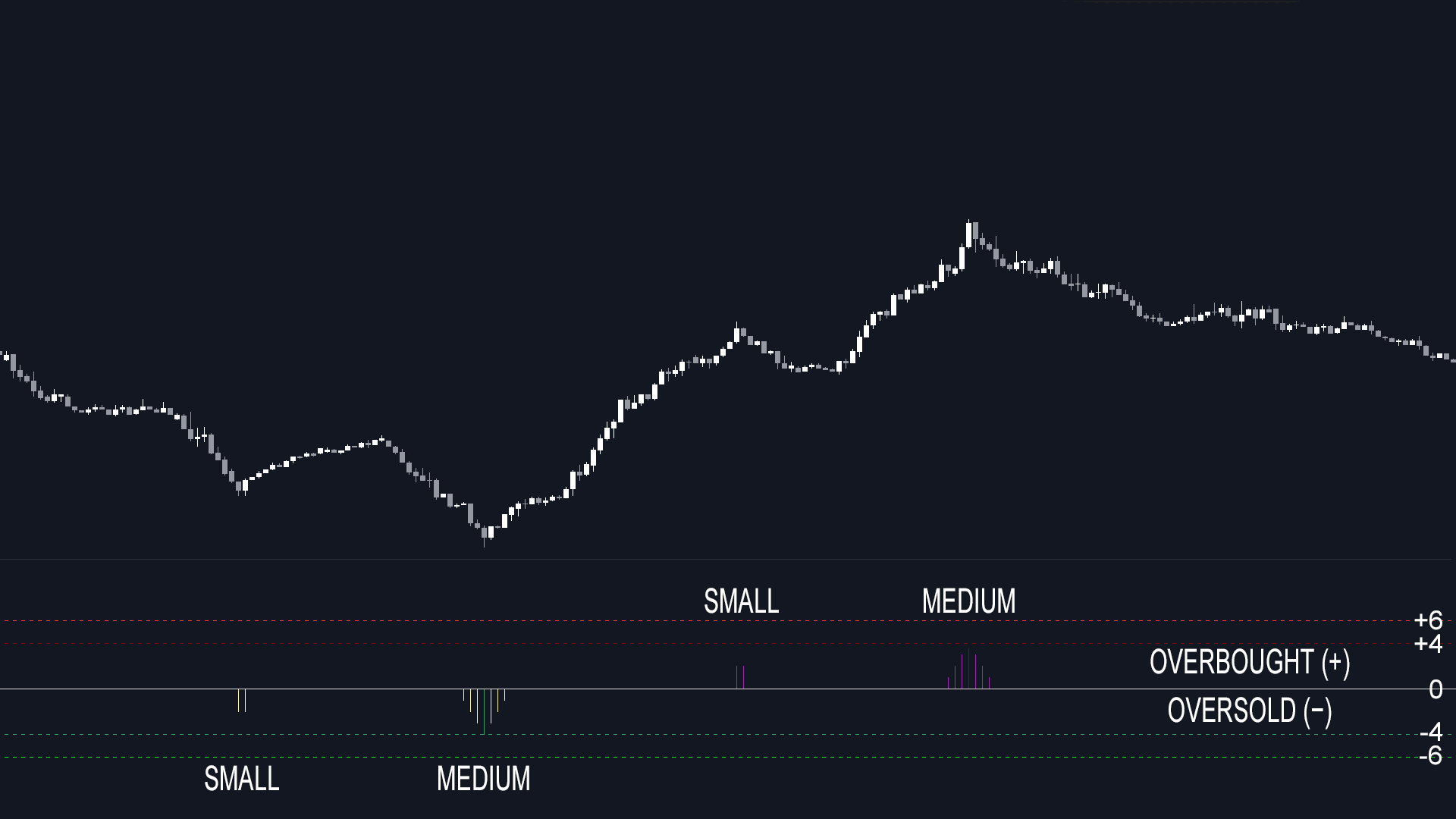

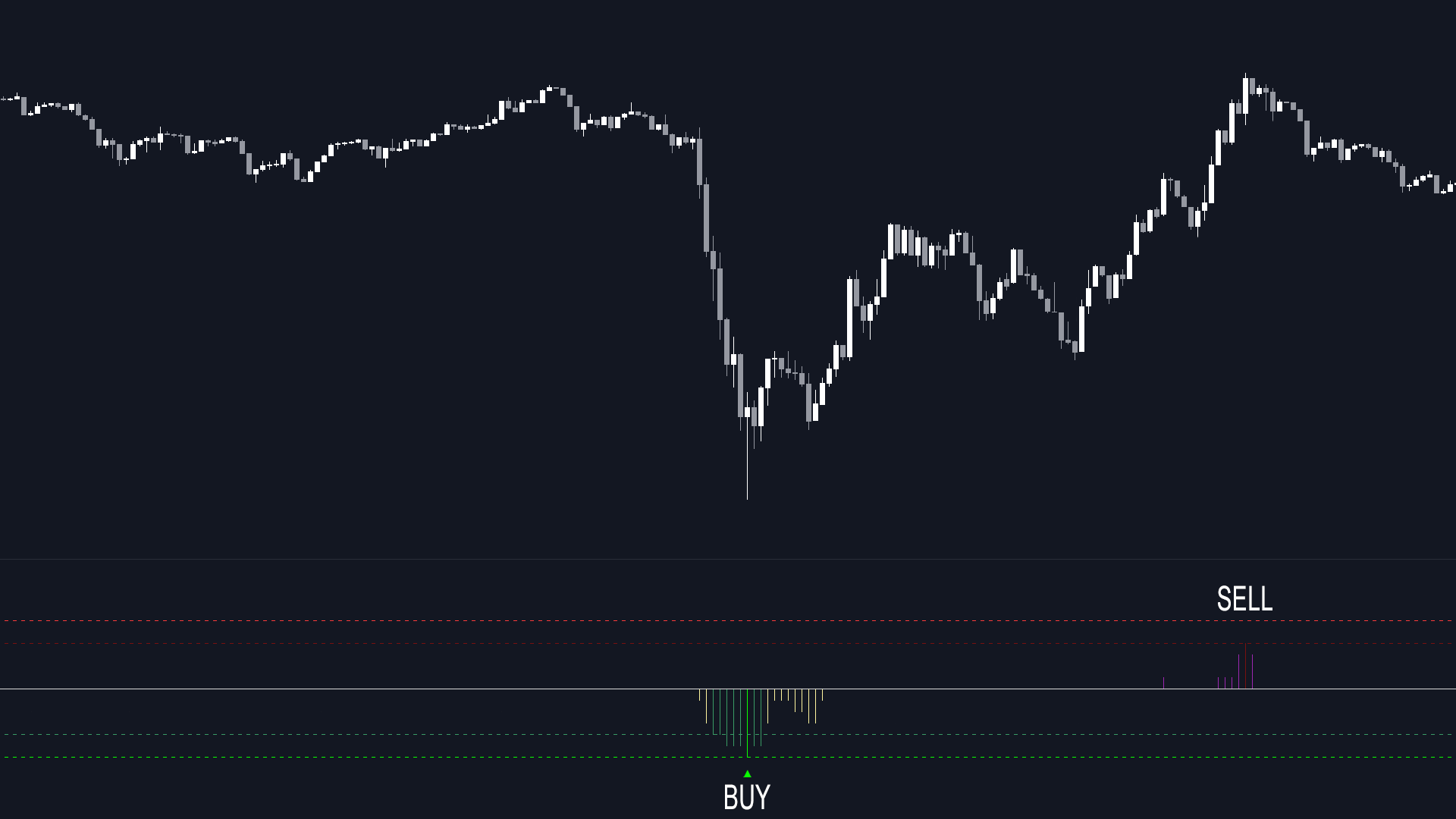

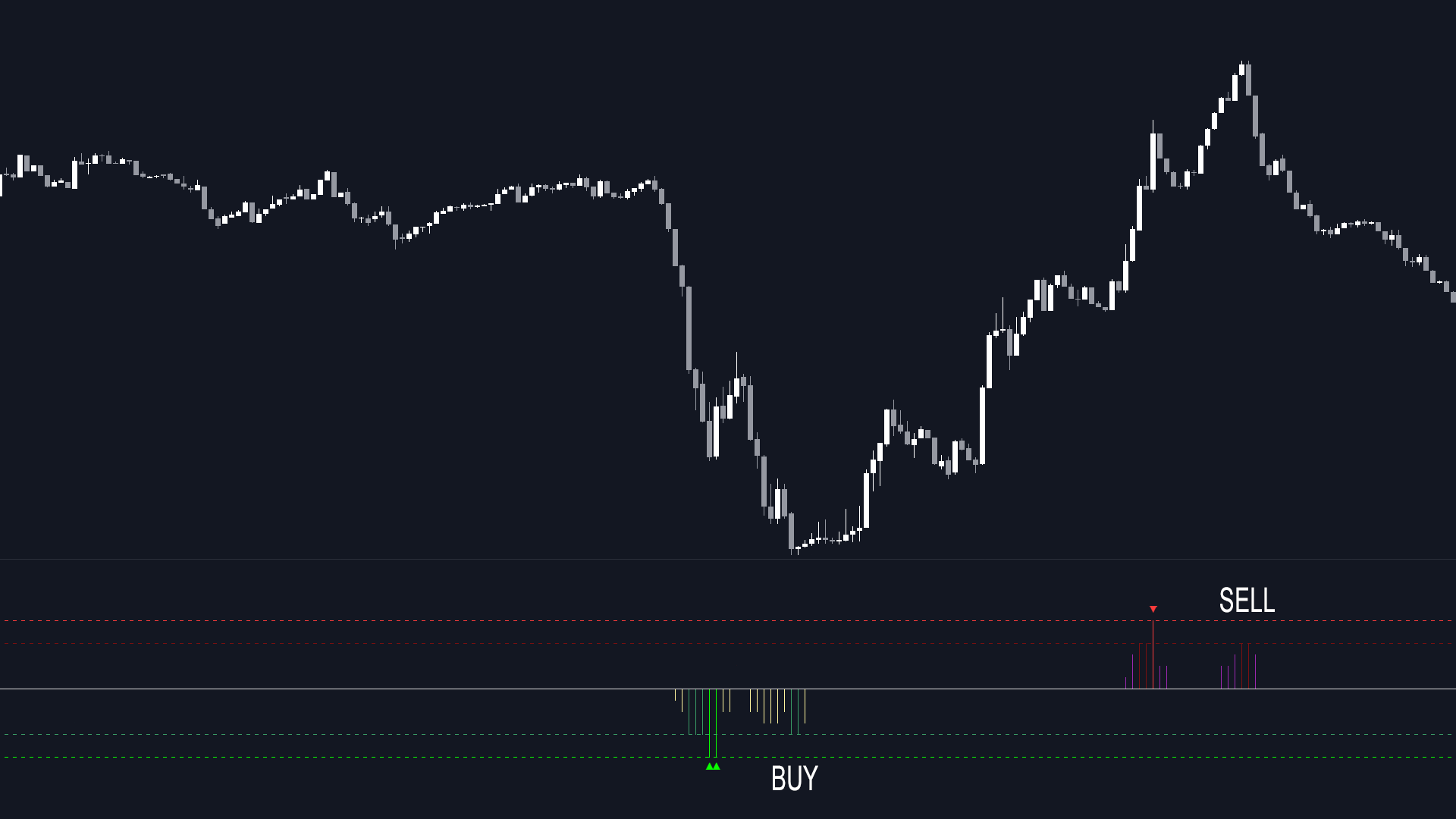

Quick-Start: Extreme Oversold (▲=Buy). Extreme Overbought (▼=Sell).ⓘ

TanHef Ranks indicator — simple trading signals using ranks.

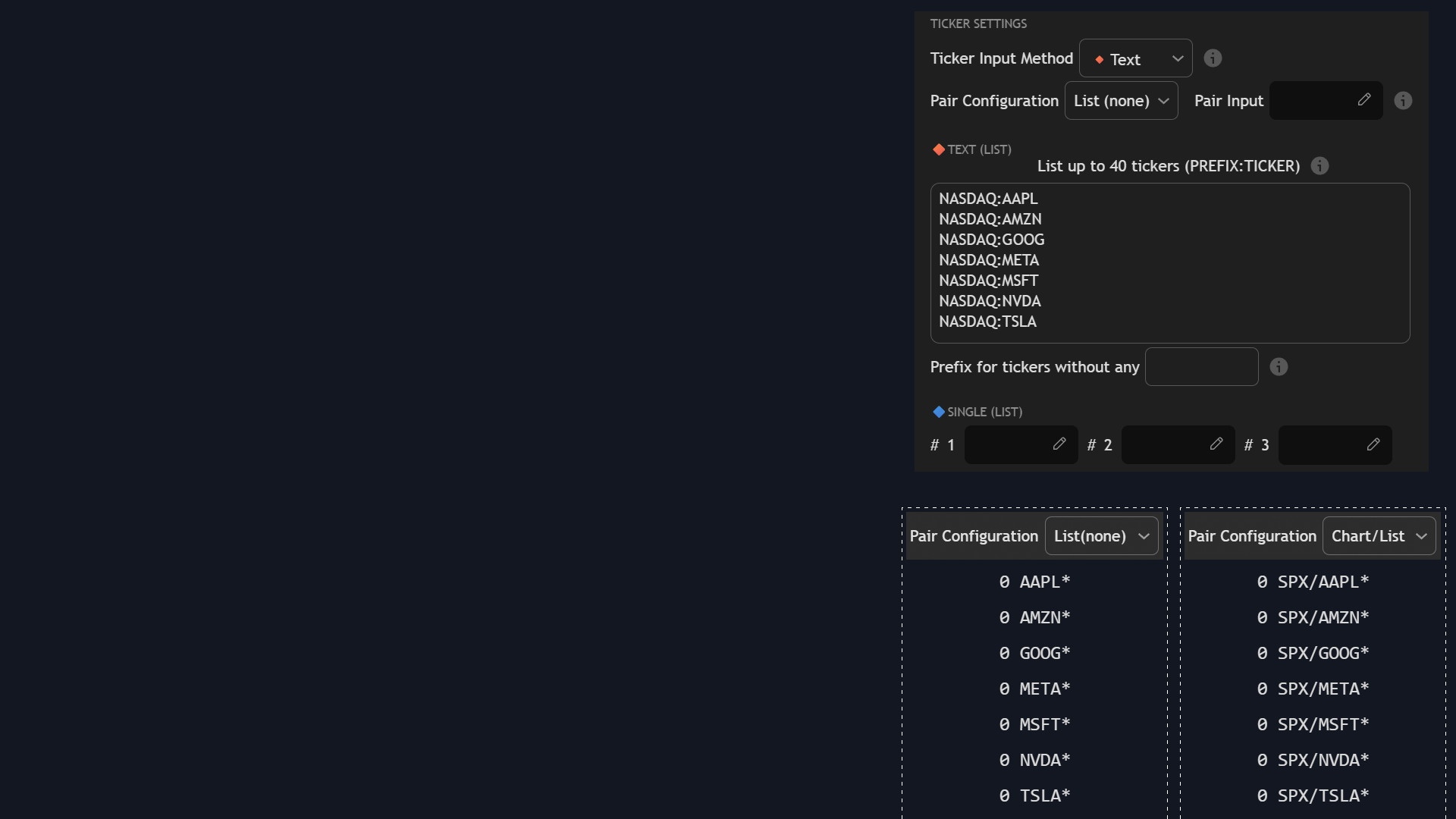

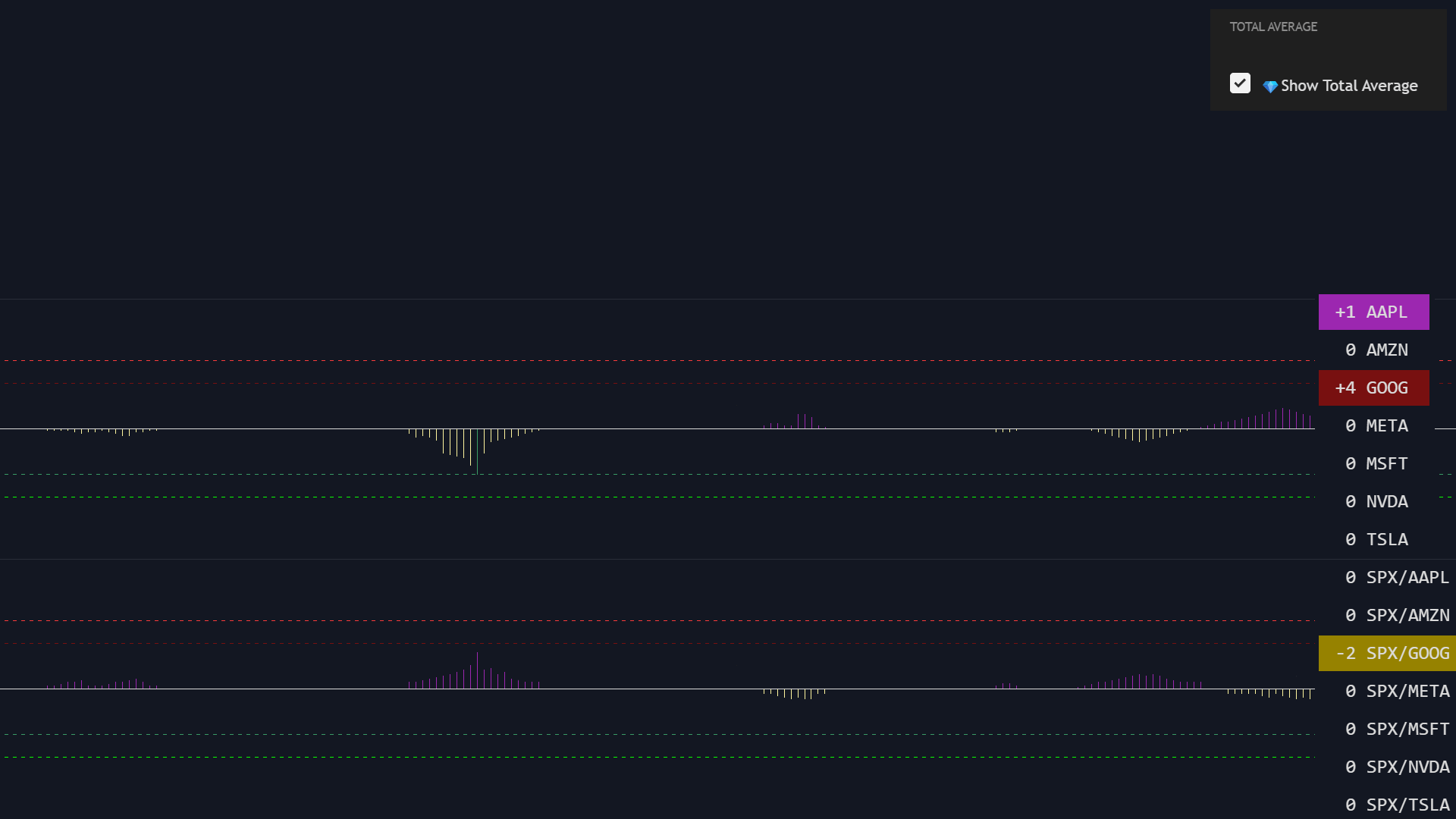

TanHef Ranks Screener — scans ranks and advanced pair analysis.

See it in action (<30s each):

Frequently Asked Questions. Select boxes to learn more:

📊 Ranks

Numeric Ranks that flag price extremes and momentum shifts.

🧮 +/− Rank

🟢Negative = Oversold (buy idea).

🔴Positive = Overbought (sell idea).

📏 Rank Size

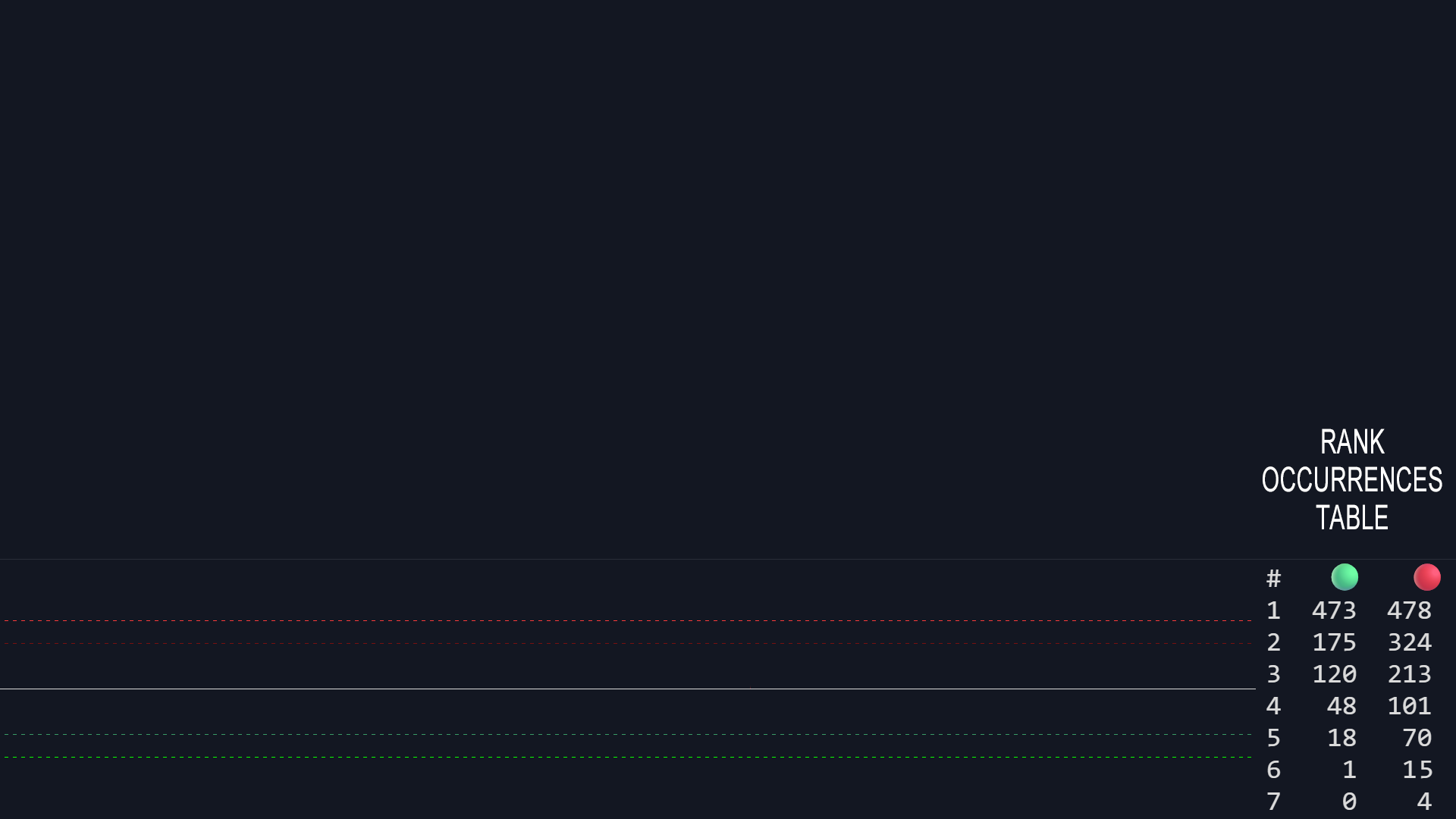

Reversal Move: ±4=small, ±6=big, ±9=huge.

Bigger = rarer = higher opportunity.

🧊 Repainting

Ranks don't change/disappear after bar close. Intrabar pullbacks (wicks) don't modify ranks, price moving more extreme increases ranks.

⚡ Intrabar vs Close

No bar-close confirmation needed. Intrabar price changes can only make a rank become more extreme.

🕒 Timeframes

Lower (5m/15m) = more/faster signals.

Higher (1H/1D) = fewer/stronger signals.

Decide based on preferred trade/hold time.

📶 Rank Frequency

Fewer: ↑rank trigger or ↑timeframe (±6, 1D).

More: ↓rank trigger or ↓timeframe (±4, 1h).

Quality > quantity

🧩️ Confluence

Large-ranks also meet small-rank's short-term criteria to boost top/bottom accuracy. Many confluences occur behind the scenes.

⭐ Best Ranks

Best odds: act on extreme ranks (▲/▼ mark them by default). Use the Occurrences Table to see extremes or near-extremes. Learn here .

📖 Buy vs Sell Logic

Emotional FOMO (Fear of Missing Out) drives pumps more than dips. Effective sell ranks are usually larger than buy ranks.

🛡️ Manage Risk

🟢Buy Rank, set stop-loss near lows.

🔴Sell Rank, set trail stop-loss, lock-in gain.

Always size risks.

📈 Trends & Ranges

Works in trends and ranges; exhaustion logic favors mean-reversion edges.

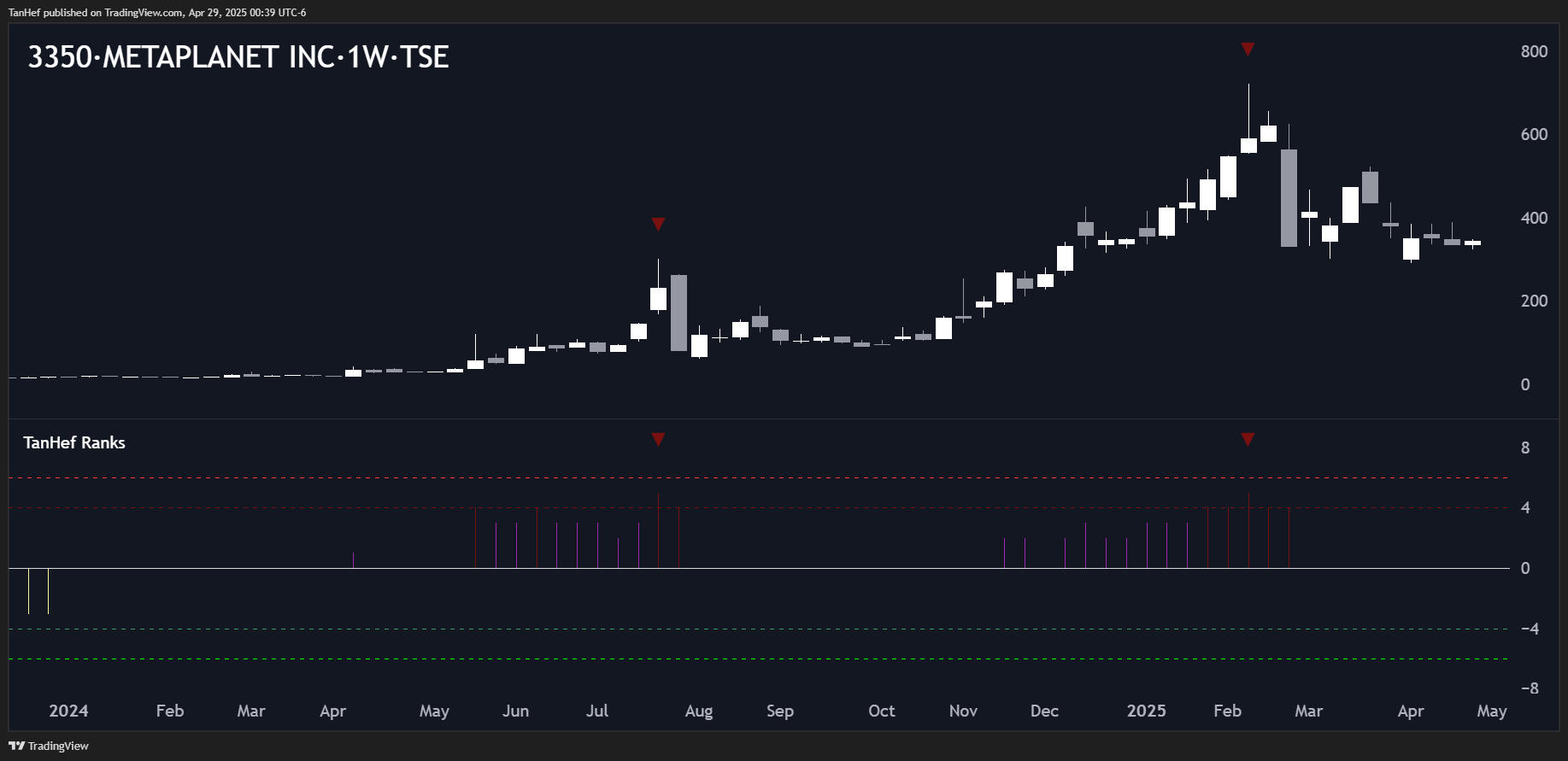

🔗 Which Tickers

Any ticker (calculation only need price).

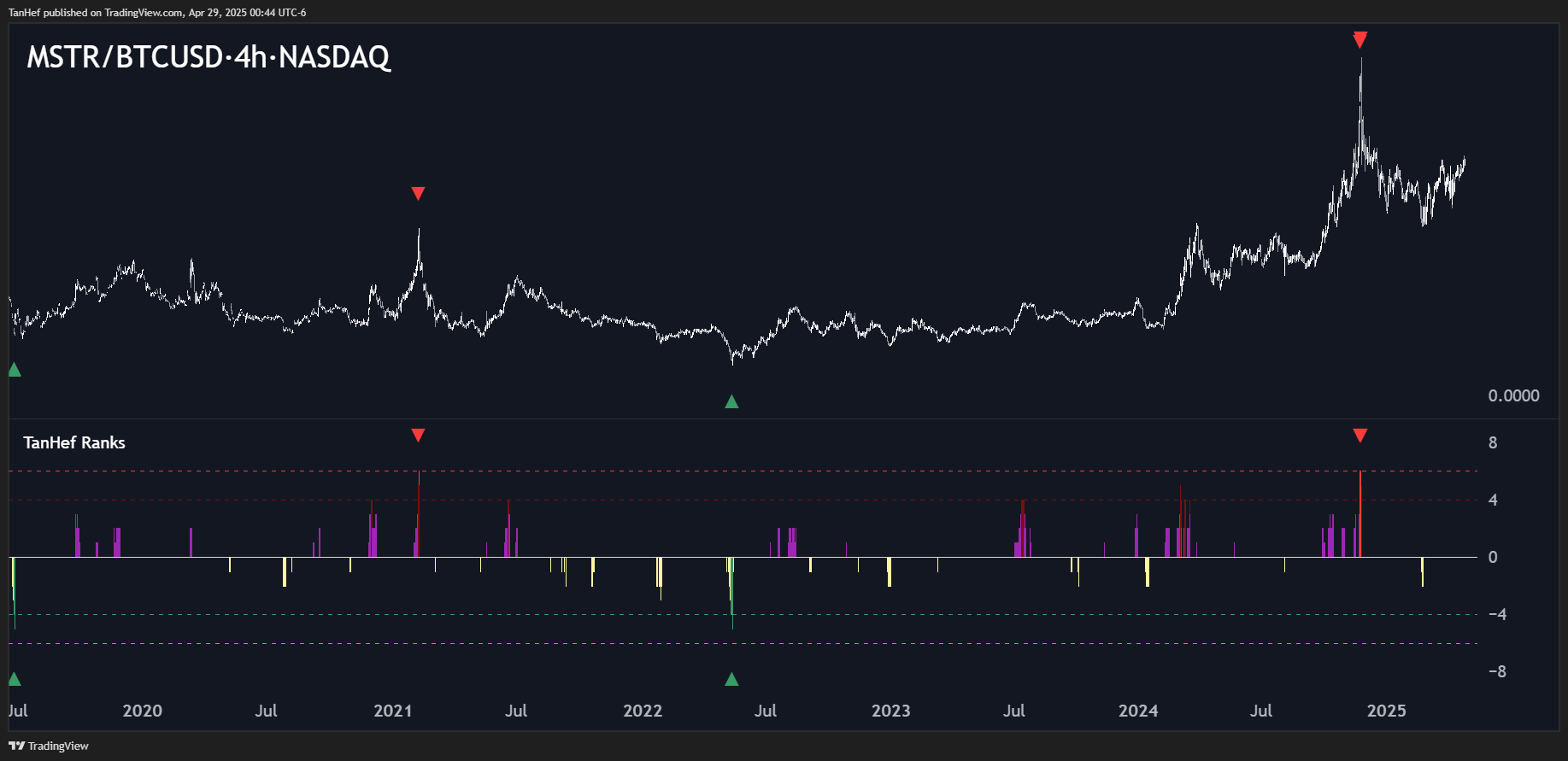

Improve confluence, also use unusual pairs. (Ex: NASDAQ:MSTR/INDEX:BTCUSD )

🦄 Rare Signals

Strict rules = fewer but better opportunities. If no signals, it’s best to be patient. No indicator can guarantee returns, but can increase odds.

🔔 Alerts & Screener

Alerts (and the screener) helps you stay patient and avoid having to stare at charts.

⚙️ Adjust Settings

Recommended: default length inputs.

Instead modify: timeframe, ranks for signals, unique ticker pairs (for hidden opportunities).

🏁 Extremes Differ

Extremes (▲/▼) only reference plotted bars.

Live Chart & Bar-Replay: 1st bar can differ.

Alerts: reference bars plotted at creation.

Old Alerts: 1st bar different than live chart.

🏆️ Why TanHef

Easy-to-understand signals makes trade analysis as simple as setting an alert. Signals are instant (many other indicators repaint or give late signals due to confirmation lag).

🔒Subscribe

Access both TanHef Ranks and Screener on TradingView.

🏆 Annual

- 2 Months Free

- Best Value

🔄 Monthly

- Cancel Any Month

- Most Flexible

🔒 Secure payment via Stripe

Request for Trial Access

Submit form or Message on TradingView for trial access.

TradingView Indicator + Screener • Easy-To-Read Signals • Alerts

Manual activation within 24h • No credit card • 100% Free Trial